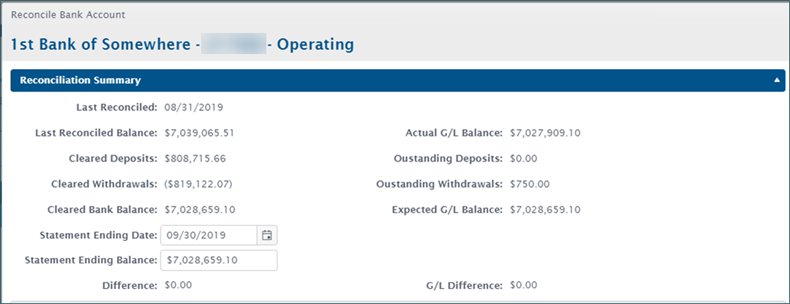

All fields except the Statement Ending Date and Statement Ending Balance are read-only, generated by the system.

Last Reconciled: The last bank statement’s ending date used in reconciling this bank account.

Last Reconciled Balance: The last bank statement’s ending bank balance. This number should also match the current bank statement’s beginning balance.

Cleared Deposits: The total deposits marked as cleared on this bank reconciliation. This figure normally matches the bank statement’s total deposits.

Cleared Withdrawals: The total withdrawals marked as cleared on this bank reconciliation. This number normally matches the bank statement’s total checks/withdrawals.

Cleared Bank Balance: The sum of the Last Reconciled Balance plus Cleared Deposits less Cleared Withdrawals. (Last Reconciled Balance + Cleared Deposits – Cleared Withdrawals = Cleared Bank Balance)

Statement Ending Date: The current bank statement’s ending date.

Statement Ending Balance: The current bank statement’s ending balance.

Difference: The difference between the Cleared Bank Balance and the Statement Ending Balance. (Cleared Bank Balance – Statement Ending Balance = Difference)

Actual G/L Balance: The sum of the G/L accounts in this bank as of the Statement Ending Date.

Outstanding Deposits: Any deposits dated before the Statement Ending Date that have not been marked as cleared.

Outstanding Withdrawals: Any withdrawals dated before the Statement Ending Date that have not been marked as cleared.

Expected G/L Balance: The sum of the Actual G/L Balance less the Outstanding Deposits plus the Outstanding Withdrawals. (Actual G/L Balance – Outstanding Deposits + Outstanding Withdrawals = Expected G/L Balance)

G/L Difference: The difference between the Cleared Bank Balance and the Expected G/L Balance. If this balance is NOT zero, additional work should be done to reconcile this difference.

Return to Bank Account Reconciliation Overview