This topic describes what you're seeing when you look at the Budget Management window.

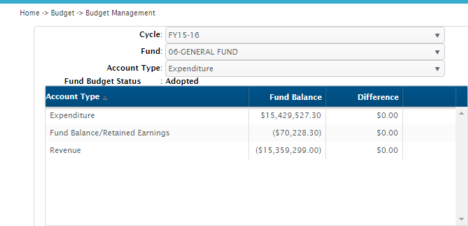

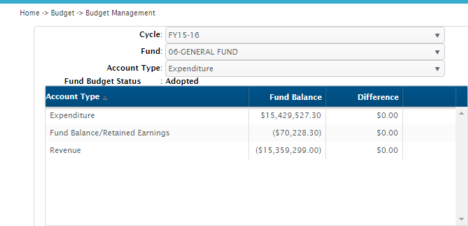

Use the top 3 drop-down list fields — Cycle, Fund, and Account Type — to select the budget you want to create, edit, or review. Note: You don't have to select a fiscal year from the Cycle list in the upper right corner of the window in order to view or work on the budget for that fiscal year.

View the budget status for the selected fund in the Fund Budget Status field immediately underneath the Account Type drop-down list.

Summary fields:

Fund Balance: This column displays the total of the Current Budget column for the different account types. In the example above, the total current budget for general fund expenditures is $15,429,527.30.

Difference: This column displays the amounts by which the budget is out of balance. In the example above, the fact that the difference is $0.00 for all account types shows that the budget for this fund is in balance. In this example, the Fund Balance/Retained Earnings accounts make up the difference between expenditures and revenues to bring the fund budget into balance. Note: If the difference between expenditures and revenues isn't zero when you try to adopt a budget, you have the option to automatically allocate the difference to the Fund Balance.

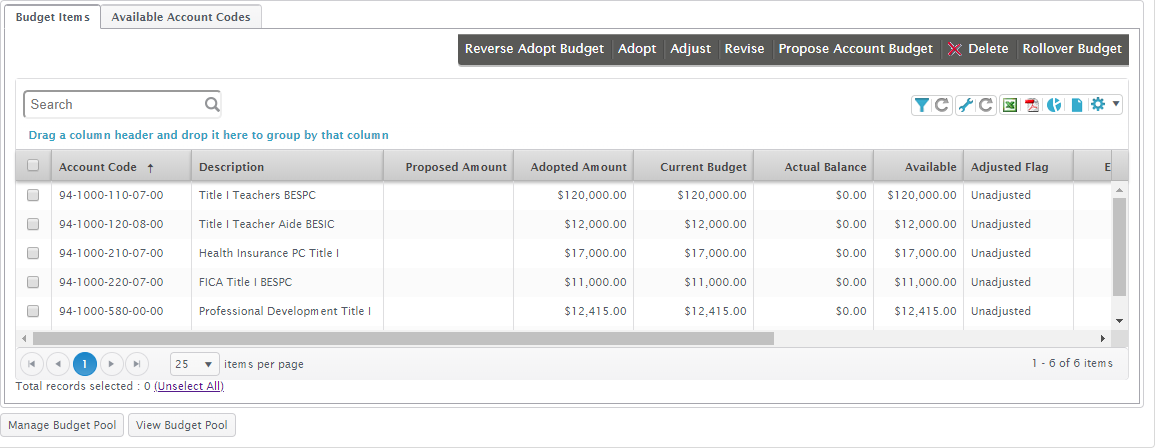

This tab displays information for the account codes for the selected account type that make up the fund budget.

Columns:

Proposed Amount: The amount of any adjustments or revisions that haven't been posted yet.

Adopted Amount: This column is empty while the budget is in the New or Proposed state. Once a budget is adopted, this column is locked and always displays the original budget amount. If adjustments or revisions are made

Current Budget: This column displays the currently accepted amount for the account. It will be the same number as the adopted amount if no adjustments or revisions have been made; if adjustments and/or revisions have been made, it will display the adjusted/revised amount.

Actual Balance: The total amount charged against or credited to the account.

Encumbrance Balance: The total amount encumbered for the account. For example, when a job is approved, the amount to be paid for the job will be added to the encumbrance column. As the employee is paid during the year, the amounts paid will be subtracted from the encumbrance column and added to the actual balance column, thus reducing the amount in the available column.

Available: For expenditures, this number equals the Current Budget minus Actual Balance minus Encumbrance Balance. For revenues, this number equals the Current Budget minus Actual Balance.

Adjusted Flag & Adjusted Date: These fields display if and when any adjustments or revisions have been posted.

Pool Flag: Displays Yes if the account is part of a budget pool.

Comment: Shows any comments entered when adjustments or revisions are posted.

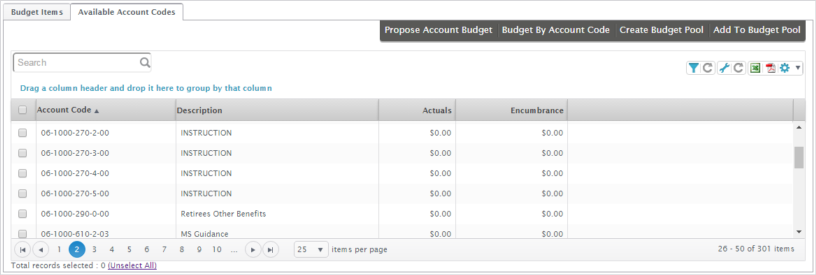

This tab includes the account codes for the selected account type that aren't included in the fund budget. These account codes can be added to the budget at any time.

Columns:

Actuals: The total amount charged against or credited to the account.

Encumbrance: The total amount encumbered for the account.

Return to Budget Management Overview